The Nobel Prize is an award of international significance. First awarded in 1901, the prizes are awarded each year to persons “who have brought the greatest benefit to humanity“, by their inventions, discoveries, and improvements in various fields of knowledge, by the literary work more impressive, or by their work in favor of peace, thus following the last wishes of Alfred Nobel, inventor of dynamite.

In the 21st century, the prizes are awarded during October each year. The awards ceremony takes place on December 10, the anniversary of the death of Alfred Nobel. However, the 2020 Nobel Prize winners will not receive their honor in Sweden due to the coronavirus pandemic.

The physical Nobel Prize giving ceremony on December 10 in Stockholm has been canceled, the Nobel Foundation announced this year, a first since 1944, when the world was still suffering the horrors of World War II. A televised ceremony will nevertheless be held on television between October 5 and 12, in the absence of the winners who will receive their prizes remotely in the categories: Medicine, Physics, Chemistry, Literature, Peace, and Economy.

This article will focus on an always polemic prize: The Nobel Prize in Economic Sciences, which this year laureated Paul R. Milgrom and Robert B. Wilson “for improvements to auction theory and inventions of new auction formats”.

Why auctions are so important for the Royal Swedish Academy of Sciences?

Auctions have been around at least since ancient times. This has proven to be an efficient mechanism for allocating scarce resources. It is generally recognized that the history of auctions began around 500 BC. AD with the Babylonian wedding market. In these writings, Herodotus would have described first-price auctions in which the hand of young women was awarded to the highest bidder. Nevertheless, in contemporary societies, auction mechanisms have traditionally been used in agriculture and animal husbandry. There are also auctions for objects and works of art, where the principal difficulty is the estimation of the cost of production. Finally, we know the famous horse auctions in Germany, in which participants throw coins into a hat to outbid!

More recently, auctions have become an increasingly popular form of buying and selling. Thus, auctions concern increasingly complex goods or services such as oil concessions, mobile telephone licenses, or even radio frequencies. There is now a very wide variety of auctions available. Interpreted in its broad sense, the term “auction” refers to any structured mechanism of a competition aimed at determining who obtains the item in question, and often at what price by causing buyers to reveal, directly or through successive offers, their reservation price. for this item.

The first conceptualization of auctions is quite recent. It is due to the American L. Friedman (1956) who developed the first operational thesis on auction mechanisms. This work takes the example of the sale of oil drilling rights in the Gulf of Mexico to private companies. During this sale, we spoke of an auction “at the first price in a sealed envelope”: the bids are not made public and it is the highest bid that wins the lots.

Like all theories, Friedman’s thesis has an important limitation: indeed, the strategies of the participants do not exist, and their future behavior is supposed to reproduce from the past, and identically. Game theory will solve part of this problem with the existence of real uncertainty and strategic interactions of the participants.

How to guess your rivals’ next step? Game theory and the role it plays in social sciences

Our two new winners started their careers in game theory. As its name suggests, game theory is the study of mathematical models of strategic interaction between decision-makers, rational or not, whose objective is to maximize a gain function following the rules of the game, which are specific for each specific scenario.

The concept of “game” is not restrictive. It can be chess, go, or checkers, but it also encompasses economic processes – as we will see – or legal, electoral, or any human activity that follows a set of specific rules. Game theory – which some academicians more generically call decision mathematics – has concrete applications in all areas of the social sciences – including the description of behavioral relationships – as well as in logic, systems science, and computer science. Game theory is the science of logical decision making in humans, animals, and computers.

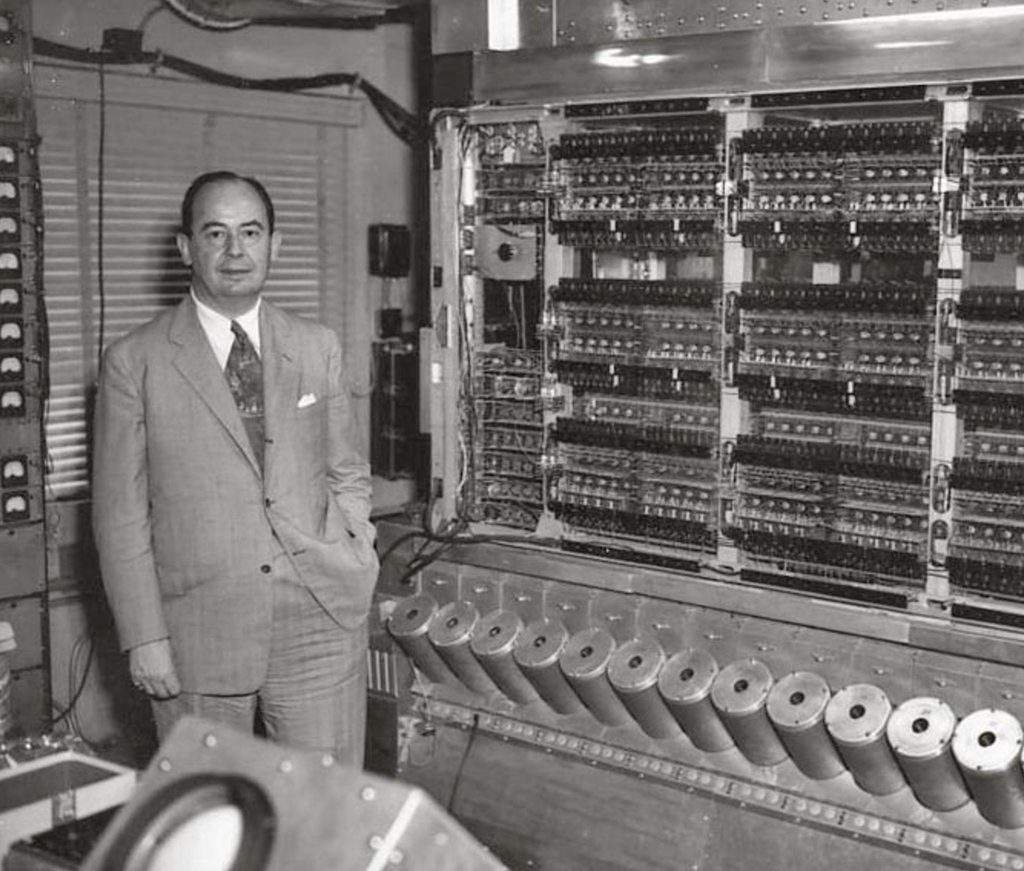

The game theory began with a paper by John von Neumann, one of the greatest intellectuals of the twentieth century, one of the fathers of quantum mechanics and computer science, and a major contributor to modern economics. His first scientific paper about the game theory topic, which used Brouwer’s famous fixed point theorem, was quickly followed by a book, Theory of Games and Economic Behavior (1944), co-written with Oskar Morgenstern, one of the countless thesis students of Ludwig von Mises who revolutionized economic analysis.

Quickly, game theory became interested in cooperative or non-cooperative, symmetric or asymmetric, zero or non-zero-sum (winnings) games, simultaneous or sequential, in discrete or continuous time, in finite or infinite time. Closer to us, these games have been extended to differential games, evolutionary games, stochastic games.

Each topic of analysis and probability gives rise to its corresponding branch of game theory. Each type of game has given rise to applications in various fields including the art of war. The research branch of the U.S. Navy gives a good idea of the early work of many military academicians on the “prisoner’s dilemma”. Similar work has been used to model nuclear war and to make them possible “gains” of the former USSR sharply negative.

Auctions: a game difficult to understand but with enormous benefits for the gamblers

While auctions do not immediately appear to be games, it must be remembered that they are essentially competitions between agents who follow a certain number of rules. Of course, an auction with a seller and a buyer is a simple economic exchange. As soon as you add either several sellers, or several buyers, or both, you get a bid. So, it is obvious – from this point of view – that game theorists have encountered economists in this field of study.

Robert B. Wilson, in his doctoral thesis, revolutionized the study of auction systems by focusing on several aspects: the development of market rules, dissemination of information through the auction process, the learning process – what does the opponent think? – during the game, as well as all the means to make these “games” more or less competitive.

This last point is important. Auction theory was developed to build mathematical models that lead to incentives to achieve certain outcomes (such as efficient allocation of resources) while maintaining a fair market that prevents collusion between bidders.

While game theory in its early days considered only zero-sum games, in which the gains of some equal the losses of others, today it applies to positive-sum games. However, the exchanges on the markets are games with positive-sum. Merchant exchange creates value ex nihilo. The consumer earns a “surplus,” the consumer surplus, which is the monetary gain obtained because he can buy a product at a price lower than the highest price, he would be willing to pay. Likewise, the producer (or seller) earns a “producer surplus” if the selling price exceeds the minimum below which he would not participate in the auction, the reserve.

As Andy Kessler brilliantly recalls in the Wall Street Journal, the consumer surplus is considerable: even for extremely simple products, market processes lead to a cascade of exchanges that make it possible to offer the consumer goods at a lower price of what it would cost him if he had to produce them himself. He recalls that according to the work of William Nordhaus of Yale University, 2018 Nobel Prize winner in economics, innovators only capture 4% of the economic gains linked to their inventions. The other 96 percent is distributed by the market among the various players.

A good example would be the expensive Microsoft Office. After all, an individual pays around $70 a year to license it, and Microsoft has accumulated nearly $ 2 trillion – market capitalization plus past dividends – through its programs. But as William Nordhaus shows, this is a much smaller sum than the value created by each user of this software, which runs into the thousands of dollars a year per user in the working world. Like any other exchange of goods, auctions create a consumer surplus and a producer surplus.

Why this work in auctions from R. Wilson and P. Milgrom is so important for science and humanity?

The beauty of the work of Robert Wilson and Paul Milgrom on auctions comes from the ability to predict the share of this consumer surplus, prevent collusion between actors, and maximize sales revenue. In the 1980s, it became apparent that radio and television frequencies were being misused and wasted. Not only could we technologically accommodate more channels on the same portion of the spectrum, but there was also no reason to reserve that spectrum for programs that no one was watching. This led to the push for the privatization of the airwaves, a theme that recurred constantly among the liberals of the day.

The two Nobel Prize winners have suggested that Congress allow the Federal Communications Commission (FCC) to auction frequencies for televisions, radios, and cell phones. This was done in 1993 when Congress passed the Omnibus Budget Reconciliation Act. The first FCC Spectrum Auction in 1993 ushered in a new era in spectrum allocation. These auctions not only earn rights for the state, they have benefited American consumers immensely. The frequencies no longer go to the friends of power or to those who are related to it but to those who are best able to value these frequencies, by exploiting them themselves or by sub-leasing them.

Quickly this was extended to cell phones. If you have a mobile phone (or a 4G LTE tablet or an IoT device), you can thank our two 2020 Nobel Laureates for making it more affordable and efficient. The auction theory developed by Milgrom and Wilson helped design new formats that are now used to sell goods and services as diverse as fishing rights, airport slots, rights of way on train lines. as well as electricity quotas.

Paul Milgrom was awarded the Nobel Prize in Economic Sciences. https://t.co/v06q3LQXw9

— All About Ann Arbor (@allabouta2) October 18, 2020

What are the limitations of their work and how their failures could affect us all?

Obviously, like all good ideas, this one has led to obvious failures in some developing and underdeveloped countries. Some governments have used auctions to ensure that they maximize the (tax) revenue from this process of allocating scarce resources, leaving little room for consumer surplus. Bankrupt states found themselves addicted to the proceeds of the license auction.

Telecommunications companies, instead of becoming more efficient, have found themselves with mountains of debt and, in the case of India, there are 50 times more subscribers per megahertz of bandwidth than in Germany.

We remember the French saga of the sale of 3G licenses in January 2001: the ultra-competent government of the time – short of dough and enticed by the extravagant prices reached by the British and German auctions – finally put the licenses on the market. sale at 32.5 billion francs after having procrastinated for months. Amid the bursting of the internet stock market bubble, only two operators, Orange and SFR, responded to the call. The operators ended up with huge license costs preventing them from investing, the process was not transparent, and the quality of service is shocking for travelers arriving in the country.

After John Forbes Nash, economist and mathematician, winner of the Nobel Prize in Economics in 1994 and the Abel Prize for Mathematics in 2015, the Nobel Committee recognized the contributions of Robert Aumann and Thomas Schelling in 2005.

For his part, Robert Wilson is not only the thesis director of Paul Milgrom but also of Alvin Roth who received the Nobel Prize in 2012 with Lloyd Shapley for, precisely, their contributions to the practice of the elaboration of market rules (market design) and game theory.

This year, the Nobel Prize committee is therefore completing a series of awards for the progress of game theory.